About Us

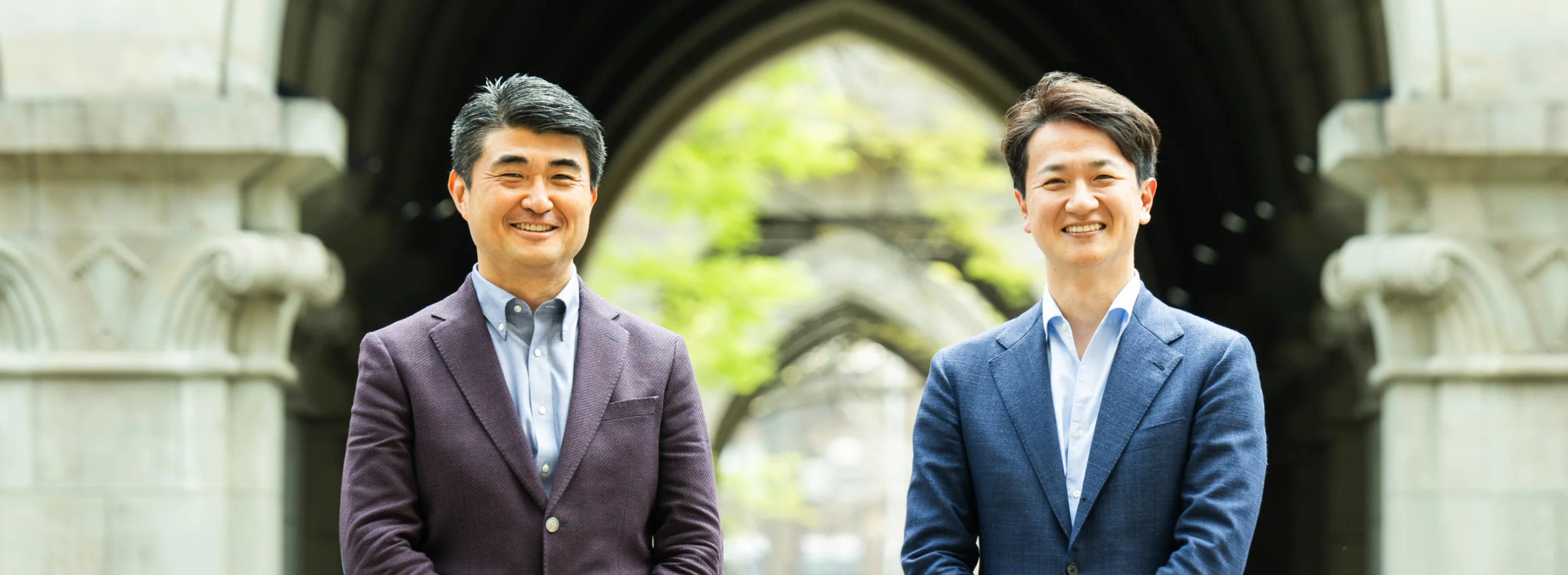

TOP MESSAGE

Since our inception back in 2004, we at UTEC have teamed up with leading universities—starting with the University of Tokyo and extending across Japan and overseas. By putting science and technology front and center, we’ve been moving capital, talent, and know-how to create new industries that tackle some of humanity’s biggest challenges.

Today, UTEC manages six core funds with total AUM of JPY 130 billion (approximately USD 1 billion) and has invested in more than 150 companies. So far, 20 of these companies have gone public, and 22 have achieved meaningful exits through M&A and other strategic outcomes. These wins are the result of countless hours poured in by entrepreneurs, scientists, and engineers across diverse fields who believe in our mission. We have always worked earnestly with entrepreneurs, scientists, and engineers across diverse fields, supporting the establishment of startups and the expansion of their achievements. We're deeply grateful for their trust and hard work.

Our newest fund—UTEC 6 Limited Partnership, established in April 2025—continues the same mandate: invest early in breakthrough science and technology, build it with strong teams, and help them scale globally to solve problems that matter. Going forward, UTEC remains committed to creating impactful startups by developing long-term partnerships and providing proactive investment and support—from pre-seed through IPO, M&A, and beyond. We will continue to strengthen collaborations with academia both domestically and internationally, focusing on startups across deep-tech.

We sincerely look forward to your continued support and encouragement.

- July, 2025

Tomotaka Goji, CEO & Managing Partner

Noriaki Sakamoto, COO & Managing Partner

OUTLINE

-

- Company Name

- The University of Tokyo Edge Capital Partners Co., Ltd.

-

- Business contents

- Venture capital fund management operation through investment activities in startups that utilize the technology and human resources of universities and research institutions such as the University of Tokyo

-

- Head office

- South Clinical Research Bldg. 3F

7-3-1 Hongo, Bunkyo-ku,

Tokyo 113-8485

JAPAN

-

- Corporation Lawyer

- Oh-ebashi lpc & partners

BOARD OF DIRECTORS

-

- Managing Partner, CEO and President TOMOTAKA GOJI

- Tomotaka (“Tommy”) Goji is the Co-founder, Managing Partner, CEO, President & Representative Director of The University of Tokyo Edge Capital Partners Co. Ltd. (known as “UTEC”), Chairman of Japan Venture Capital Association (JVCA). Since the inception of The University of Tokyo Edge Capital Co. Ltd. in April 2004, he has raised and managed six funds totaling approximately JPY 130 billion, built the team, and guided investments, value-up and exits of UTEC portfolio companies. 20 of which went public and 22 of which achieved other forms of substantial exits, mainly in the form of M&As. These UTEC funds are established on the premise of the Japanese law called "The Limited Partnership Act for Investment" that he authored to enact in 1998 at the then Ministry of International Trade and Industry (MITI, now known as METI: the Ministry of Economy, Trade and Industry) and became the foundation for Japanese venture capital funds thereafter. He left the government to initiate UTEC, after engaging in legislation at the Agency for Cultural Affairs and the Financial Services Agency. He has served Japan Venture Capital Association as Managing Director (July 2015 – July 2022) , Vice Chairman (July 2022 - July 2023), and Chairman (July 2023 - present). He has also researched on data science to analyze success factors for scientific startups. He graduated from the University of Tokyo’s Faculty of Law in 1996, earned his MBA at Stanford University in 2003, and received his Ph.D. from the University of Tokyo’s School of Engineering in 2020.

-

- Managing Partner, COO and Representative Director NORIAKI SAKAMOTO

- Nori Sakamoto is a Managing Partner, COO and Representative Director at UTEC, focusing on high growth seed/early stage life science and IT fields. He served as a board member auditor in ACSL (listed in the TSE Mothers in December 2018) and Repertoire Genesis (acquired by Eurofins Scientific SE), and a board member in Neural Pocket (listed in the TSE Mothers in August 2020). JDSC Co., Ltd.(listed in the TSE Mothers in December 2021), Finatext Holdings Ltd.(listed in the TSE Mothers in December 2021), Institution for a Global Society Corporation(listed in the TSE Mothers in December 2021) and ELEMENTS, Inc.(listed in the TSE Mothers in December 2022). Prior to joining UTEC in August 2014, he worked at McKinsey and Company. As an engagement manager, he worked on projects for pharma, medical devices, auto, high-tech, consumer goods and retail companies in Japan, Southeast Asia, and Europe. Prior to McKinsey, he worked in his family business as a president and then for the Ministry of Economy, Trade and Industry (METI). He was engaged in developing the acts for SME finance and home appliance recycling. Nori graduated from the University of Tokyo’s Faculty of Economy in 2003, earned his MBA from Columbia Business School in 2010. He was a co-translator of “Valuation: Measuring and Managing the Value of Companies” at McKinsey. He is currently General Manager of Planning Department of of Japan Venture Capital Association (JVCA).

-

- Chairperson KEIJI MOGI

- Keiji Mogi is the chairperson of UTEC. He graduated from Sophia University’s Faculty of Foreign Language in 1964, received a master's degree in University Catholic de Louvain in 1965, sponsored by Belgian government. At Mitsui Bank (currently SMBC), he served as the chairperson secretary of the general affairs department , deputy branch manager of New York branch, head of Brussels branch after Foreign department, London branch, Brussels branch, and Head office.

He served as the Public relations manager at Sakura Bank (currently SMBC) Director of Public Relations (assumed to be the director of the same bank in 1992). In 1996, he joined Sakura Card Co., Ltd. as a vice president, in 1997 he served as the Senior Vice President at Sony Life Insurance Co., Ltd. From 2006 to 2016, he served as an advisor to Bridgepoint Capital in the UK. From 2007 to 2012, he was Professor in the Department of Economics at Teikyo University. From 2006 to 2025, he also served as an advisor to VenCap International Advisor in the UK.

-

- Partner and Board Director ATSUSHI USAMI

- Atsushi Usami is a Partner and Board Director at UTEC, focusing on seed/early-stage life science investments. He currently serves on the boards of EditForce Inc., Bugworks Research inc., bitBiome Inc., Celaid Therapeutics Inc., PURMX Therapeutics Co., Ltd., United Immunity, Co., Ltd., RegCell, Inc. and others. He led investments of Repertoire Genesis Inc. (Acquired by Eurofins Scientific SE) and OriCiro Genomics, Inc.(Acquired by Moderna, Inc.). Prior to joining UTEC in October 2013, he worked as a strategy consultant at Mitsubishi Research Institute, serving pharmaceutical, medical device and other manufacturing companies across a range of areas including mid-to-long term management planning and new business development.In 2012, he received a Ph.D. in pharmaceutical sciences from the University of Tokyo. He provides support for Life Science Innovation Network Japan (LINK-J).

-

- Director (external) MSAO HIRANO

- Masao Hirano is currently a Professor at Waseda Business School (Graduate School of Business and Finance), and the president of Japan Business Model Association. He has an extensive professional background in both private equity investment and management consulting. He graduated from Tokyo University’s Faculty of Engineering, Department of Applied Chemistry in 1980 then joined at JGC Corporation as a project engineer. In 1987, he joined McKinsey. He became a partner in 1993, served as a managing partner, Tokyo. From 2007 to 2011, he was a Co-Head of Carlyle Japan, one of buy-out funds of a global asset management firm, in which he led a few private equity investments in Japan. He graduated from Stanford University, M.S. Engineering Economic Systems.

-

- Director (outside company) CHRISTINA L.AHMADJIAN

- After graduating from Harvard University in 1981, she joined Mitsubishi Electric Corporation in 1982. She earned her MBA from Stanford Business School in 1987 and her Ph.D. from the Haas School of Business, University of California, Berkeley, in 1995. After serving as Assistant Professor at Columbia Business School, and Professor at Graduate School of Business Administration, Hitotsubashi University, she currently serves as a Professor Emeritus at Hitotsubashi University. Since 2009, she has served as a member of the board (outside director) at Eisai, Mitsubishi Heavy Industries, JPX, Sumitomo Electric, Asahi Group Holdings, NEC, and NGK Spark Plug. She is a U.S. citizen and has lived in Japan for over 25 years.

-

- Corporate Auditor (external) HIROYUKI TAKAHASHI

- Hiroyuki Takahashi is an external corporate auditor of UTEC. He graduated from the University of Tokyo’s Faculty of Nuclear Engineering in 1987 (Master of Engineering). In 1989, he became a research associate. He served as a Lecturer at the international cooperation and education office, Associate Professor of Research into Artifact, Center for Engineering, Associate Professor of High Energy Research Organization, Professor of Department of Nuclear Engineering and Management and Department of Bio-engineering. After that, he is now a Professor at Institute of Engineering Innovation, The University of Tokyo. Since April 2014, he serves as a Special Advisor to the Dean of Engineering, The University of Tokyo. Since November 2017, he also serves as a Vice Director of Division of University Corporate Relations, The University of Tokyo.

-

- Corporate Auditor (external) KAZUKI NAKAMOTO

- Kazuki Nakamoto is currently a member of Asset management committee of Kindai University and an advisor to Crosspoint Advisors, Japan’s leading independent advisory firm. He graduated from Osaka University’s Faculty of Science Department of Math in 1976 then joined Daido Life Insurance Company. He became a Manager of Operations Planning Department in 1996, served as the Board Director in 1998, the Managing Director in 2001, the Director and Managing Executive Officer in 2006, the Senior Managing Executive Officer, Director in 2007, the Representative Director Senior Managing Executive Officer in 2008, the Senior Managing Executive Officer, Director in 2010, later the Standing Corporate Auditor, and retired the Standing Corporate Auditor in 2014.

FUNDS

As of April 2024

-

- UTEC 6 Limited Partnership

-

- Establishment

- April 30, 2025

- General Partners

- UTEC Venture Partners Limited Liability Partnership

- Fund size

- About 46.1 billion yen

- Number

of Investments - 10

-

- UTEC 5 Limited Partnership

-

- Establishment

- May 7, 2021

- General Partners

- UTEC Partners Limited Liability Partnership

- Fund size

- About 30.4 billion yen

- Number

of Investments - 40

-

- UTEC 4 Limited Partnership

-

- Establishment

- January 17, 2018

- General Partners

- UTEC Partners Limited Liability Partnership

- Fund size

- About 24.3 billion yen

- Number of Investments

- 36

-

- UTEC 3 Limited Partnership

-

- Establishment

- October 15, 2013

- General Partners

- UTEC 3Partners Limited Liability Partnership

- Fund size

- About 14.5 billion yen

- Number of Investments

- 31

-

- UTEC 2 Limited Partnership

-

- Establishment

- July 31, 2009

- General Partners

- The University of Tokyo Edge Capital Partners Co., Ltd. UTEC Venture Partners, Inc.

- Fund size

- About 7.1 billion yen

- Number of Investments

- 13

-

- UTEC 1 Limited Partnership Exit

-

- Establishment

- July 1, 2004

- General Partners

- The University of Tokyo Edge Capital Co., Ltd.

- Fund size

- About 8.3 billion yen

- Number of Investments

- 34