UTEC’s Edge

GLOBAL

UTEC Global

Creating New Industries to solve Global Issues of Humankind

by bringing Capital, Talent, and Knowledge, around Science and Technology

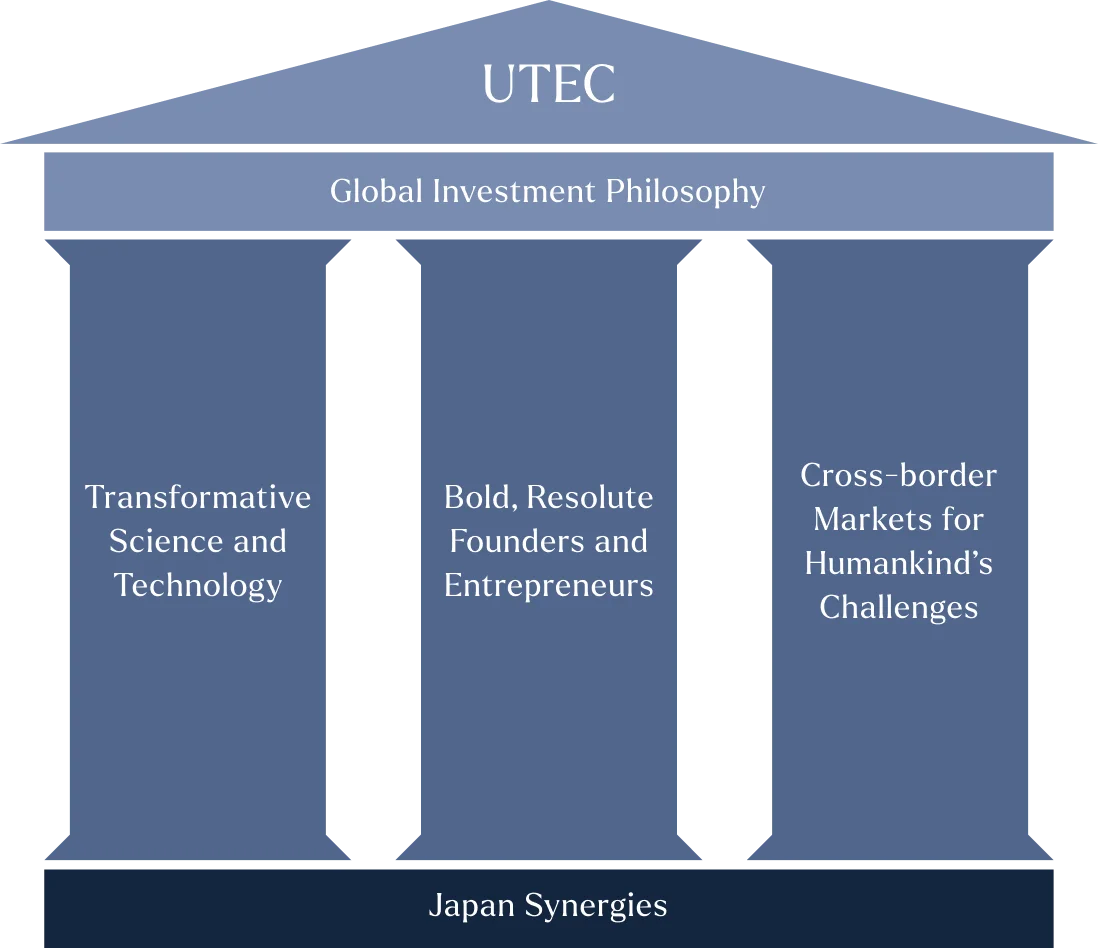

OUR GLOBAL INVESTMENT PHILOSOPHY

Our Global Investment Philosophy

At UTEC, our motto is to create new industries to solve global issues of humankind by bringing capital, talent, and knowledge, around science and technology. The tenet that science and technology have no boundaries is core to our philosophy. At the core of this philosophy is the belief that science and technology know no borders; truly exceptional innovations earn recognition everywhere. UTEC supports startups by connecting them with Japan’s science, technology, and industrial strengths, to achieve success on a worldwide stage.

Our Global Investment Performance

OUR VALUE-ADD

Our Value-add

Our experience of investing in over 150 deep-tech startups since 2004

has crystallized our DNA as hands-on, value-add investors.

ENABLING JAPANESE

STARTUPS TO GO GLOBAL

Enabling JapaneseStartups to go Global

Some of the issues affecting present-day Japan such as ageing population,

labor shortage, digital transformation of legacy industries and revitalization of economic growth will be faced by other countries in the future.

We encourage our Japanese startups to have a global outlook from day one and actively support their international expansion in the following ways.

ENABLING GLOBAL STARTUPS TO

BUILD THEIR FOOTPRINT IN JAPAN

Enabling Global Startupsto build their Footprint in Japan

We seek tangible Japan synergies for the global startups we invest in.

The startups are not mandated to have an active business in Japan before our investment, so long as there is scope for potential collaboration with Japanese academia & industries.

We actively support our global portfolio startups to accelerate their growth by building bridges to Japan:

CONTACTIf you are a seed/early-stage deep-tech startup from anywhere

in the world with Japan synergies, we would love to hear from you.

Please reach out to us here.