About Us

INVESTMENT POLICY

Investment policy

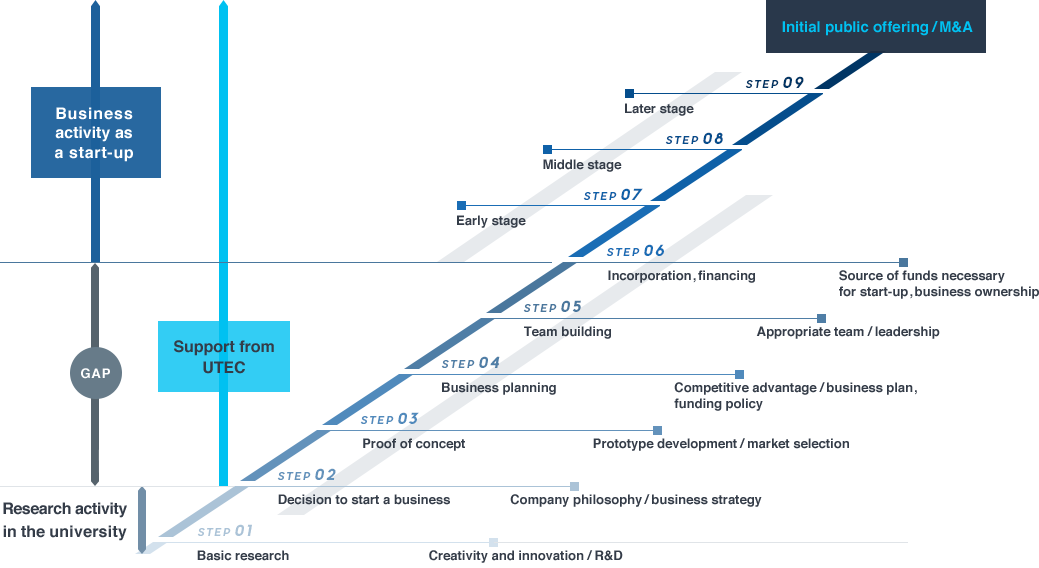

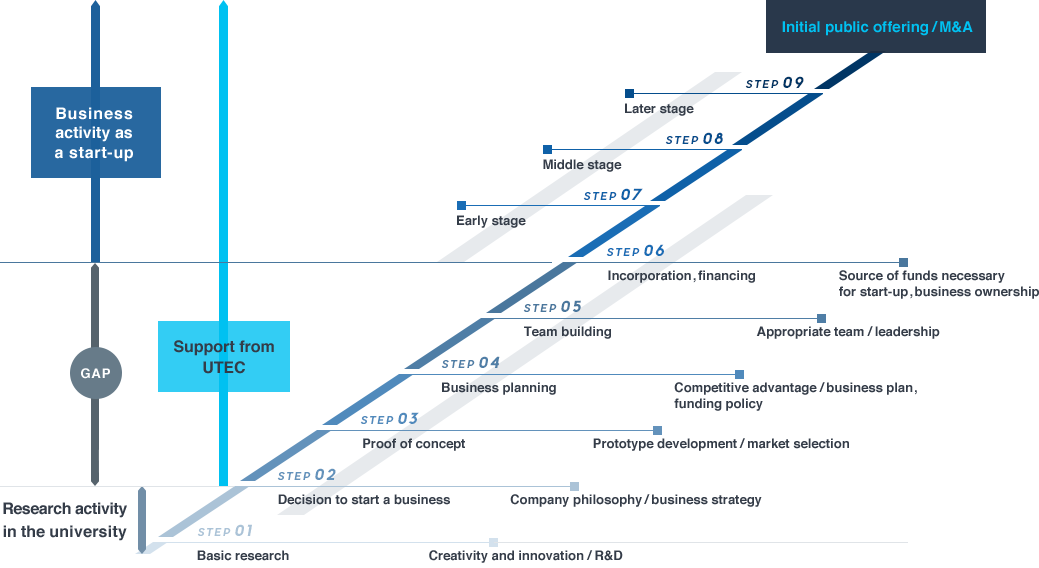

UTEC invests and supports in with various growth stages including before the incorporation of companies.

We focus on creating projects in collaboration with the University of Tokyo and various research institutes and companies.

INVESTMENT PHILOSOPHY

Investment Strategy

We create new industries to solve global issues of humankind by bringing capital,

talent, and knowledge, around science and technology

-

01PHILOSOPHY

- Innovative Science and Technology

-

- ・Sourcing science and technology with real-world impact from academia such as the University of Tokyo, as well as other research institutions, corporates, and governments

- ・Building science and technology across multiple organizations

-

02PHILOSOPHY

- Strong Teams

-

- ・Focusing on skilled management teams that excel in product development and operations management

- ・Building great teams that can drive a business based on science and technology

-

03PHILOSOPHY

- Global Markets and Issues of Humankind

-

- ・Supporting entrepreneurs with a vision to expand to the global markets

- ・Joining the challenge to solve issues of humankind

INVESTMENT FLOW

COMMITMENT

Strong commitment

As a lead investor, we will support management and finance aspects of startup ventures.

Ratio of lead position *1,2

-

UTEC 1

34

-

UTEC 2

13

-

UTEC 3

31

-

UTEC 4

34

-

UTEC 5

38

- Lead

- Others

- (# investments):%

* Dispatch directors and corporate auditors to most startups, actively participating in value-up / management support

* 1 Lead positions in the past finance, the ratio of the number of cases

* 2 December, 2024. Investments from multiple funds are counted in each.(FoF investments are not included)

FAQ

Does UTEC invest only in “deep tech”?

UTEC has an investment strategy focused on startups with outstanding science and technology. However, we also invest in companies that may not initially be considered “deep tech”, but have the potential to significantly enhance their business value through the future integration of science and technology. In such cases, UTEC takes a proactive, hands-on approach to support these companies along the way, including during the process of adopting advanced technologies.

What investment stages does UTEC target?

UTEC invests in pre-incorporation, seed, and early stage startups. For companies in which we have made early-stage investments, we continue to provide follow-on support through the middle and later stages in line with their growth and development.

Does UTEC only invest in startups originating from the University of Tokyo?

Our investment activities focus on co-creating ventures together with researchers and entrepreneurs from a wide range of universities and research institutions both in Japan and overseas. As long as the startups align with UTEC’s investment strategy, we actively invest in startups that are not necessarily affiliated with the University of Tokyo.

Does UTEC invest in international startups as well?

Yes, UTEC has been investing in global deep-tech startups for over a decade by leveraging our strong network of Japanese and international research institutes.

In our overseas investments, we place strong importance on connections to Japan. This connection may involve collaboration on technology, opportunities for market expansion, or strategic partnerships.

Today, we have invested in more than 30 global startups with Japan Story elements across the United States, India, Southeast Asia, Europe, and Africa. Furthermore, we continue to expand our global reach by collaborating with universities, research institutes, and venture capital firms in these regions to discover promising opportunities and create lasting value.

Does UTEC act as a lead investor?

Yes, UTEC typically leads or co-leads investments in seed and early-stage startups. We are committed to providing continuous and hands-on support throughout the entire company lifecycle.

What is the typical investment amount?

We typically invest tens of millions to several hundred million yen in initial rounds, and actively provide follow-on investments as the company grows. As a result, our total investment in a single company can reach between one and three billion yen.

What kind of value-added support does UTEC provide after an investment?

UTEC provides extensive support to our portfolio companies by dispatching directors and corporate auditors to most startups, actively participating in value-up / management support.

In addition to dedicated investment professionals, UTEC offers bothour HR team and other domain experts, including Venture Partners (VPs) who specialize in various fields, to provide multi-layered support to our portfolio companies. Our service covers a wide range of areas, including Accounting and Finance, Technology, Intellectual Property, Legal Affairs, Public Relations, Global Business Development, and in IPO and M&A.

How can I arrange a meeting with UTEC?

When reaching out to UTEC, we encourage you to contact one of our investment professionals through an introduction, if possible.

If you do not have a direct contact, please feel free to use the inquiry form available on our website.